It takes a long time and a lot of effort to get to where you can finally start your business. But the hard work doesn’t stop, once you begin running your firm.

You will face a slew of other milestones and obstacles, accounting being one of them.

Accounting is critical as you start your small business. It allows you to keep track of all your transactions and financial information. Something you can do by creating invoices and payroll.

In this blog post, I will go over a few pointers on managing Accounting for small business and share what actions you need to take as a business owner to ensure that your small business flows efficient and without damage.

Simple Bookkeeping for Small Business

Bookkeeping is one of the most straightforward accounting processes to keep track of your financial data.

Now let’s go through some phrases to ensure you’re not making any mistakes when doing simple bookkeeping for your Small Business.

1.Separate your Personal and Professional Finances in accounting

If you put your personal and business money on the same page, it will be a disaster.

To avoid this, construct a source document to maintain track of your business transaction. It is the most basic concept in Accounting.

Read more about how to separate your personal & business transactions.

2.Maintaining your Record

Keep track of your daily recurring transactions. It will aid in the analysis of your business financial situation. That is why it is critical to have a suitable system or notebook to keep track of all sales and purchases.

Maintain a capable Accounting system. It helps ensure that you have no problems when it comes to filing tax returns.

ProfitBooks is a popular accounting software. You can use it to create invoices, record expenses and track inventory.

3.Ledger

It is an account that summarizes your transaction history as they appear on your balance and income statements.

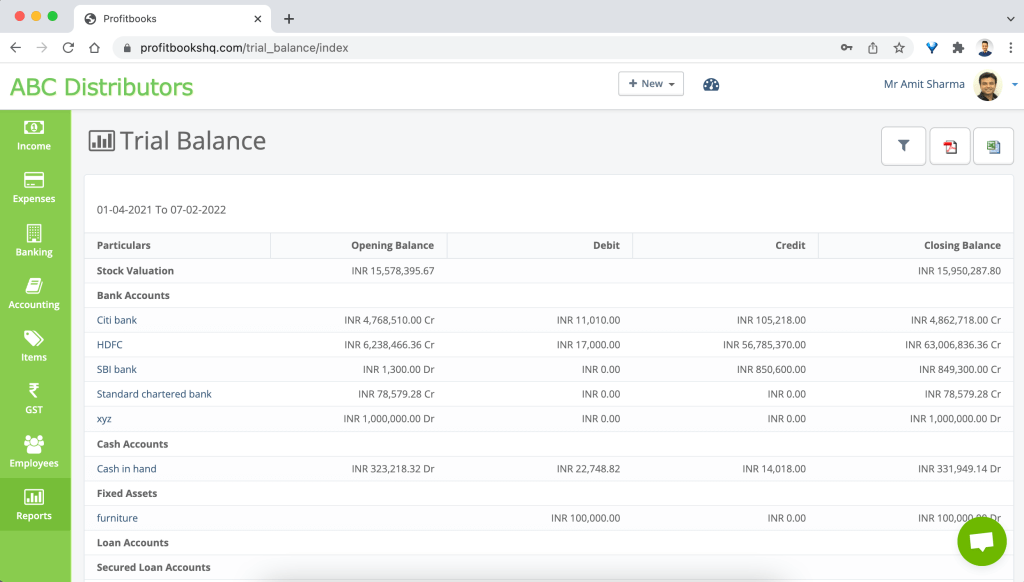

4.Trial Balance

Two types of balance made before printing the financial report.

-

Unadjusted Trial Balance: Balances from a ledger account to check and change entries after a reporting period to compile financial statements. The unadjusted trial balance done in the initial point to check account balances and adjust entries.

-

Adjusted Trial Balance: It is a balance prepared after the entries are adjusted in the list before preparing financial statements. This shows the account balance after adjusting entries and correcting errors that happened in the unadjusted trial.

5.Adjusting Entries

After a trial balance has generated, adjusting entries are done at the end of the accounting period.

Adjusting entries can help with any accounting activity. The following are the five common:

-

Revenue that is earned

-

Piled up expense

-

Revenue not earned

-

Revenues from prepayments

-

Devaluation

6.Financial Report

A financial statement or financial report best describes your Small Business financial status.

At the end of accounting, there are four primary forms of statements:

-

Net profit statement

-

Income statement

-

Financial position statement

-

Stockholder statement

Accounting System for Small Business

When you own a small business, you must also take care of your accountingsystem. It is to complete your to-do list for your financial situation.

It will ensure that your accounting system and your Business are on the proper track.

Here are some key components to consider while setting up a system.

1.Bank Account

Register a business account to keep track on cash flow. Also keep track of all incoming and outgoing transactions as soon as you start your business.

2.Accounting Method

You must select an accounting system. For managing the business’s cash flow and reporting profits and costs.

You can choose from three different accounting methods:

-

Cash base: The most basic method of keeping track of your transactions. Many small businesses and individuals prefer to do their accounting in cash.

-

Accrual base: Many businesses use accrual accounting because it keeps track of income and expenses regardless of cash flow.

-

Hybrid method: This method is the combination of cash and accrual methods of accounting.

Whatever method you choose, the accounting must be consistent throughout a fixed timeframe.

3.Track Your Transactions

Accounting starts with keeping track of your transactions. As a Small Business owner, you have the alternative of paying an accountant to keep track of all your transactions. As well as you can use paid software tools to do so.

4.Accounting Report

After completing your transaction monitoring, assemble all your financial data. Now, create a report based on your business transactions and progress.

5.Payment Plan

You have the option of doing business with your customers on credit or cash. If you choose to work on credit and collect payments later, ensure a consistent system for creating and delivering invoices.

Hire an Accountant or Outsource Accounting

Hiring an accountant is a sensible move. As it relieves you of maintaining financial records throughout the year. This also saves you a lot of time and money.

An accountant will perform the following responsibilities for your Small Business.

-

Make a business strategy.

-

Provide you with business structuring advice.

-

Aids in the acquisition of a business license, tax permits, and a payroll account.

-

Create a report using accounting software.

-

Deal with difficulties relating to sales taxes.

-

Managing labor costs, wages, and regulations.

-

Assist you in meeting your license agency needs.

-

Keep track of recurrent transactions by date.

As an owner of a Small Business you and your business need to keep track of each financial information through the accounting system. From opening a bank account to keeping track of transactions, everything has to be up to date. So that your business can run smoothly and your cash flow to be maintain and organized.

Many owners don’t stress themselves out with financial-related problems. Instead, they look for options to hire an accountant who can do this duty and generate a financial statement every year.

Of course, you, too, can do that. But that will take your focus away from your business.

Check out the Remote Bookkeeping service offered by ProfitBooks. You just need to send your invoices, bills, bank statements and the team of experts take care of the rest. You also get a monthly review call with an advisor.

Final Thoughts

When starting a new business, it’s important to setup a good accounting system. This will ensure that you stay on track with your finances and comply with the tax laws.

You can either hire an in-house accountant or outsource it to professional service providers like ProfitBooks.

In both the cases, you are going to need a good accounting software that is easy to use.

ProfitBooks helps you to organize all your finances, record expenses and track inventory.